The tectonic plates of global economy are shifting. The status of the US as the de facto economic leader is being challenged by China. In the 2000s the economic growth in China has outpaced every other nation by a comfortable margin. This has meant that increasing number of countries are tied to the Chinese economy. Particularly developing countries with a need for capital and other aid have increased trade with China. This expansion has decreased the relative power of the US and the EU. Some have called this the new scramble for Africa (Harchaoui et.al.) although I would argue that the African colonialization has continued even after countries gained independence after WWII. What is new however is the larger presence of China on the continent, that has started to rival the Western nations. As the shifting of actual tectonic plates rip Africa apart so does the changing global economic landscape.

I want to take a look at this situation and consider what does this change mean for the African countries, its institutions and economic development. For the basis of my analyses I will use the paper “Carving Out an Empire? How China Strategically Uses Aid to Facilitate Chinese Business Expansion in Africa” by Tarek M. Harchaoui, Robbert K. J. Maseland and Julian A. Watkinson. They examine how China has used development aid programs ODA (official development aid) and OOF (other official flows) to increase African countries dependence on itself and expand their foreign markets. It is out of the scope of this essay to compare how Chinese aid and its effects differ from the Western aid in detail. Here I will only focus on the effects of Chinese aid.

Overview of the aid

In the research literature (Naim 2007) on development aid to Africa, China has been seen as a rogue donor. This means that China uses aid as a tool to increase its economic and subsequently political influence, which decreases the democratic institutions and local competitiveness of a country. This is different from the European and western aid, where the investment is tied to institutional conditions. There needs to be democratic institutions in order for a country to get aid. China has stepped up its investments in the recent decade as it has established institutions such as the Asian Infrastructure Investment Bank in 2015 to rival the World Development Bank. This has raised fears on African development and some western donors have tried to counteract the Chinese expansion with strategical aid (Kilama 2016). (Harchaoui et.al. 2020)

In their paper Tarek M. Harchaoui, Robbert K. J. Maseland and Julian A. Watkinson analyse this Chinese rogue donor argument. There has been discrepancies between the empirical findings and the public perception of Chinese aid. Empirically there has been little evidence that China uses aid strategically, yet the fears of increasing Chinese influence and the rogue donor argument persist in the literature. Harchaoui et. al. approach this contradiction by modifying the assumptions of the previous research. First, they look at the allocation of aid as a function of the proportion of imports and exports rather than the absolute value of trade between the receiver country and China. Secondly, they dissect the economic interests of Chinese aid into resource-seeking and market-seeking. Thirdly they look at different types of aid, ODA and OOF. ( Harchaoui et.al. 2020)

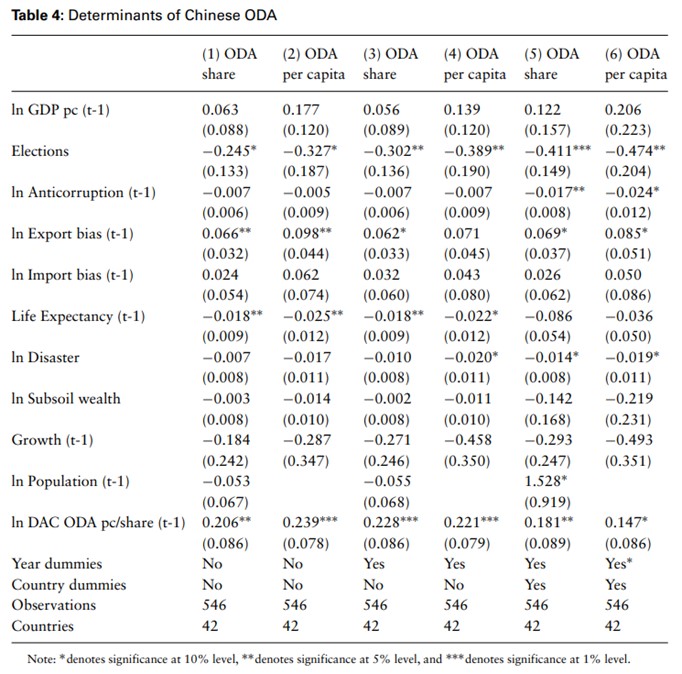

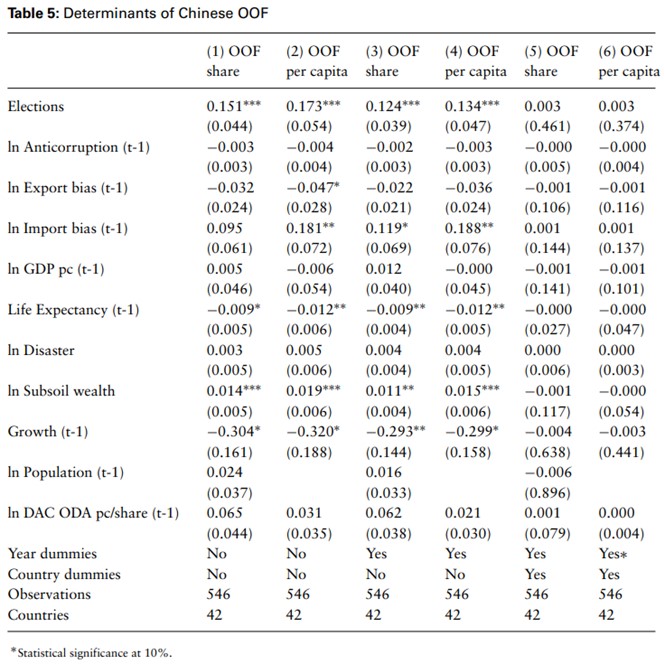

The paper present two hypotheses. 1) Chinese ODA is positively associated with the share of recipient countries’ total exports that are flowing to China, while OOF is positively associated with the share of recipient countries’ imports that originate from China. And 2) Chinese ODA is negatively related to democratic institutions, while Chinese OOF is positively relate. Since there was missing values in variables, a normal OLS regression model could not be used. Instead Harchaoui et.al. used a Tobit regression, which accounts for the fact that the data was not normally distributed. They also used dummy variables for UN voting patterns and French colonies to make the regression robust. Variables included in the regression were GDP, life expectancy, disasters, anticorruption, elections, trade, oil wealth and growth. The dependent variable was the aid (ODA/OOF).

Regression tables (tables 4 and 5) are presented below. Results confirm the hypotheses. ODA is directed to countries with weaker democratic institutions and more corruption, which enables China to capture the natural resources and increase their economic and political influence (Harchaoui et.al.). The effect of the aid was also relatively large with a 1% increase in ODA increasing export bias by 10% (Harchaoui et.al.). If the democracy of a country is too strong and China cannot bribe or capture the natural resources, then OOF aid is used to secure privileged access for the Chinese firms into the target country’s market (Harchaoui et.al.). Almost as a mirror image a 2% increase in OOF was associated with 10% increase in import bias to China (Harchaoui et.al.). From these results, the rogue donor argument seems to have some ground. China’s aid allocation has strengthened its economic power in Africa.

The sectoral allocation of Chinese aid

Aid from both of the ODA and OOF programs has not been divided equally to all sectors. China has focused heavily on the transportation/storage, communication, and energy (Harchaoui et.al.) . Transportation makes up the largest percentage with a 19.8% and 23.6% share in ODA and OOF respectively. Energy is the second largest single sector, with 14.3% and 14.9%. Interestingly the energy share is almost the same in both aid programs. This could be because energy is important for both extracting resources as well as enabling local business growth. Harchaoui et.al. note that China is less committed to government, health, environment, and civil society. Because energy is central for both of ODA and OOF, I will focus on it and explore what effects this has on African economies.

“Africa needs investment to improve energy access of hundreds of millions of people and if the needed funding is not available from the EU or the US, then they will get it from China.”

Africa’s investment needs

The results that Harchaoui et.al. presented support the rogue donor argument. But could there be some different interpretation of the results? China’s role in the global economy has grown considerably since the 1970s when the country started economic reforms to increase growth (UNCTAD, “China: The rise of a trade titan”, 2021). From 1990 to 2018 Chinese share of the global exports has risen from 1.2% to 11.4% (The World Bank). Increase in the Chinese aid programs should then be no surprise. Africa has a need for investment and aid to close their infrastructure gaps (McKinsey 2020). In the 2018 report by the Infrastructure Consortium for Africa, it was found that transportation and energy sectors accounted for nearly 75% of the total investment between 2013 and 2017 (McKinsey 2020). The Chinese aid allocation to transportation and energy sector therefore seem much more understandable. Large infrastructure projects are something that China is already familiar with and are relatively easy to tackle as opposed to corruption. China has not made any public outings on why they specifically focus on these sectors, though I will doubt if they even would The potential political backlash and more counteractive aid programs from the West that could harm the Chinese goals.

Energy sector in sub-Saharan Africa

Energy encompasses everything from oil, coal and gas to wind and solar power. It is a large and diverse sector. I will only focus on the renewable energy sources, wind, hydro and solar, as China has invested heavily on them (Lema et.al. 2021). Renewables have vast potential in Africa, large rivers provide basis for hydro, wind can be built almost anywhere and solar takes advantage of the large amount of sunlight on the continent (Lema et.al. 2021). Because of these favourable factors renewables account for 75% of the new energy production (Lema et.al. 2021). In addition to ODA and OOF, these renewable energy sources are a major investment area in China’s Belt and Road Initiative (BRI) that aims to increase global GDP (Nedopil 2021). There have also been the concerns about increasing greenhouse emissions as African countries increase their living standards. Chinese (and other) investment into the renewables sector is thus crucial for fighting climate change (Powanga & Giner-Reichl 2019).

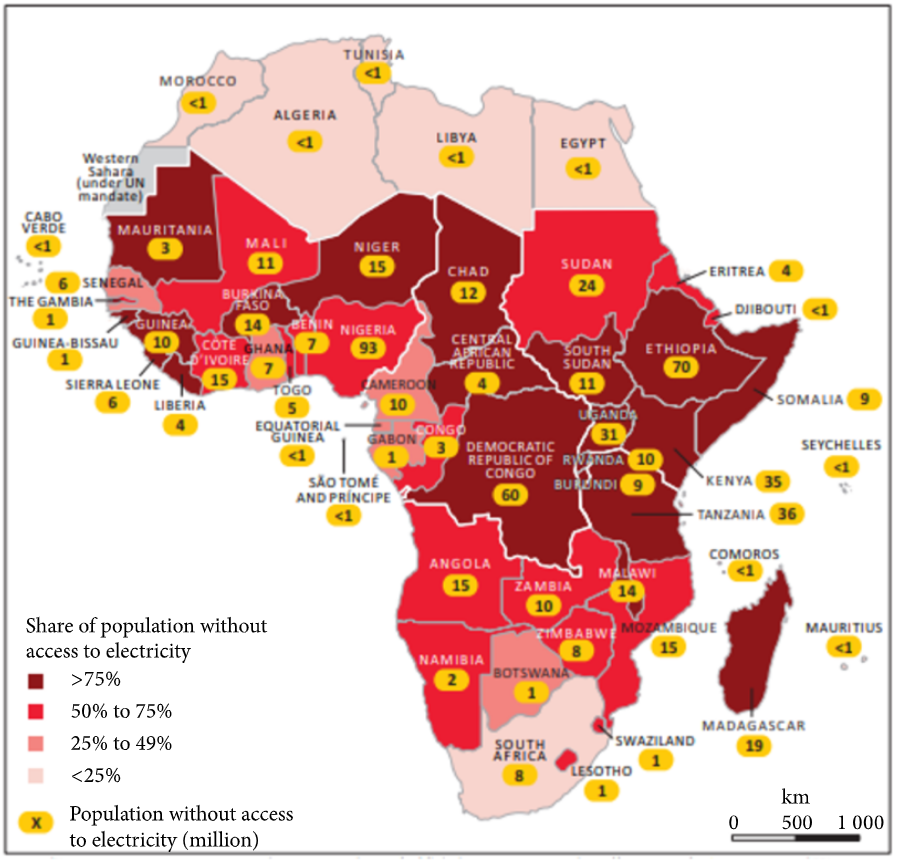

Africa is of course the largest and one could argue, most diverse, area in the world. Many of the African countries are at very different stages of development. I want to narrow my focus on the sub-Saharan Africa. This is because of two factors. Firstly, the energy needs are more pressing in sub-Saharan Africa. The International Energy Agency (IEA) estimated that by 2030 there will be 674 million people without access to electricity, of these 600 million will be in sub-Saharan Africa (Powanga & Giner-Reichl 2019). The access to energy is presented in figure 1. The demand and need for energy is most pressing there. Because of the large demand China is increasingly involved in renewable deployment in sub-Saharan Africa (Lema et.al. 2021). Out of the 46 sub-Saharan countries, 43 are in the BRI (Nedopil 2021), underlying the Chinese commitment to the region. Sub-Saharan Africa is thus the best place to analyse if we want to know more about the effects of Chinese aid.

Co-benefits

Major energy plans and investments in sub-Saharan Africa focus on the renewable sector. Harchaoui et.al. concluded that the investment in energy from both ODA and OOF are driven by the Chinese economic and political interests. But how does the investment and the projects materialise and potentially benefit the African countries? Rasmus Lema et.al. in their paper “China’s investments in renewable energy in Africa: Creating co-benefits or just cashing-in?” examined this question. The paper covered three projects, each using a different renewable energy source; Adama project in Ethiopia (wind), Bui dam project in Ghana (hydro) and Garissa project in Kenya (solar). The results from these projects cannot be generalised without additional assumptions, but they give a good baseline of how China operates on the ground level.

Lema et.al. identify three possible co-benefits from energy projects. First the increasing job opportunities in terms of maintenance tasks in the local area. Second, there could be economic growth with the inclusion in the value chains. This is a contested argument in development economics and depending on where the country is in the value chain, it might not get the economic benefits, or the benefits might be sub-optimal (Goldberg & Reed 2020). Third possible benefit is the technology transfer if the local universities and other research institutions are included in the project.

In the three cases covered, only bounded local co-benefits could be identified. The inclusion of universities was limited, so there was virtually no technology transfer. There was increase in the job markets and some economic growth benefits from the inclusion in the value chains, but larger involvement of the local communities would have increased these benefits. The poor results for the recipient country are due to differences in negotiating power (Lema et.al). China prefers to directly negotiate contracts for its investors and developers in the renewable-energy sector in Africa rather than participate in open bidding systems (Shen 2020). In all three cases the local governments were weak. Because of this China is able to leverage its power to privately negotiate contracts and the developers and contractors do not need to work closely with the communities, which decreases the co-benefits (Lema et.al.). This gives empirical grounds to the findings of Harchaoui et.al. The projects are usually offered on a turnkey basis as a bundled package (Lema et.al.), potentially increasing the production of these projects. This in turn enables China to capture large share of the energy markets for its own use, giving empirical ground to how OOF is used.

The conclusion of Lema et.al. is that the co-benefits of Chinese renewable energy projects do not rise automatically, they need to be actively sought out. The increased investment does not necessarily improve the long-term economic development because the local needs are not adequately taken into consideration.

Colonial battles

Based on the papers presented in the previous chapters, the Chinese energy investments do not seem to benefit Africa much. The perception is that China aims to re-colonise Africa to boost its own economy and expand its political influence. But the effect on Africa might not be all that different from the Western presence. Luka Powanga and Irene Giner-Reichl present a different picture in their paper “China’s Contribution to the African Powe Sector: Policy Implications for African Countries”, arguing that the Chinese involvement in Africa is not new nor undesired.

The relations between China and Africa go back to the mid-20th century when delegates from the Chinese Communist Party started to visit and develop trade relations in many African countries (Powanga & Giner-Reichl 2019). Africa has been important for the growth of the Chinese economy, being one of the main sources of minerals, oil and gas (Powanga & Giner-Reichl 2019), so there has been a self-interest for China to create these relationships. The authors acknowledge this dependence but note many African countries have viewed this cooperation as mutually beneficial, especially in energy sector. Powanga and Giner-Reichl frame the current development of Chinese and African relations as the continuum of historical ties. It is expected that the expansion of China has angered Western countries as their market share shrinks. The expansion of Chinese influence in Africa decreases the economic and political leeway of the West. The rogue donor argument could be seen as a embodiment of this frustration.

“The expansion of Chinese influence decreases the economic and political leeway of the West.”

The contrary viewpoints are an example of the global power struggle between China and the West mixed with the local needs of African countries. The empirical evidence (Lema et.al.) and research on the aid allocation (Harchaoui et.al.) suggests that the aid and investments into energy do not necessarily improve the economy of the recipient country and are politically motivated. The counter argument is that Africa needs investment to improve energy access of hundreds of millions of people and if the needed funding is not available from the EU or the US, then they will get it from China. Some argue China has a central role in the expansion and development of the African renewable energy infrastructure and generation (Powanga & Giner-Reichl). Between 2005 to 2012 Chinese investment into African energy sector has totalled to 11 billion USD by the official accounts and could be as high as 29 billion USD (Gualberti et.al. 2014). This is not to say that there will be no future implications. The consequences of this Chinese aid are not immediately visible, and it could take some time before they can be estimated. Harchaoui et.al. noticed that the voting patterns of African countries in the UN had not changed to conform China. In the future this might not be the case if economic dependence on China continues to grow, especially in energy, as this sector has large leverage to the whole economy.

Conclusions

The aid and investment policy of China aims to strengthen the economic growth and expand the markets of domestic firms. This has not yet translated to increase in political power over African nations on the international level but where there is economic power, there is also the potential for political influencing. From the papers I have presented it is clear that the economic goals are at the forefront of Chinese aid policies in Africa. It is not evident from these results that China wants to control politics of any given country. If this would be the case, we would expect to see some advocacy for China in the UN voting by the African countries. The correlation of corruption and democracy to ODA and OOF respectively can result from the fact that China does aim aid strategically but only to advance their economic goals. Because there has been no official outing from China on their policy in Africa, we cannot definitively confirm this, but the statistical evidence is strong. The large difference between the size of any African country and China in terms of economy or political power grants China the upper hand in negotiating contracts, and thus the local co-benefits are not usually fully explored. Politicians of these countries should thus be vary about the effects of these projects.

References, in the order of relevance

Harchaoui Tarek M, Maseland Robert K J, Watkinson Julian A (2020) “Carving Out an Empire? How China Strategically Uses Aid to Facilitate Chinese Business Expansion in Africa”. Journal of African Economies, Volume 30, Issue 2.

Lema Rasmus, Bhamidipati Padmasai L, Gregersen Cecilia, Hansen Ulrich E, Kirchherr Julian (2021) “China’s investments in renewable energy in Africa: Creating co-benefits or just cashing-in?”. World Development, Volume 141.

Shen Wei (2020) “China’s role in Africa’s energy transition: A critical review of its intensity, institutions, and impacts”. Energy Research & Social Science, issue 68.

Nedopil Christoph (2021) “China’s Investments in the Belt and Road Initiative (BRI) in 2020”. International Institute of Green Finance, CUFE.

Powanga Luka, Giner-Reichl Irene (2019) ” China’s Contribution to the African Power Sector: Policy Implications for African Countries”. Journal of Energy, Volume 2019.

Goldberg Pinelopi K., Reed Tristan (2020) “Income Distribution, International Integration and Sustained Poverty Reduction.”. World Bank Policy Research Working Paper 9342.

Nicita Alessandro, Razo Carlos (2021) “China: The rise of a trade titan”. UNCTAD news.

Lakmeeharan Kannan, Manji Qaizer, Nyairo Ronald, Poeltner Harald (2020) “Solving Africa’s infrastructure paradox”. McKinsey&Company article.

Gualberti Giorgio, Bazilian Morgan, Moss Todd (2014) “Energy Investments in Africa by the U.S., Europe and China”. International Association for Energy Economics.

Naim Moises (2007) “Rogue Aid”. Foreign Policy, issua 159.

Kilama E. G. (2016) “Evidences on donors competition in Africa: Traditional donors versus China”. Journal of International Development, issue 28.

The Global economy.com, Percent of world exports – Country rankings, 2018. (https://www.theglobaleconomy.com/rankings/share_world_exports/)